Predicting financial default risks: A machine learning approach using smartphone data

Keywords:

Financial Default , Machine Learning , Predictive Analytics , Risk Prediction, Smartphone DataAbstract

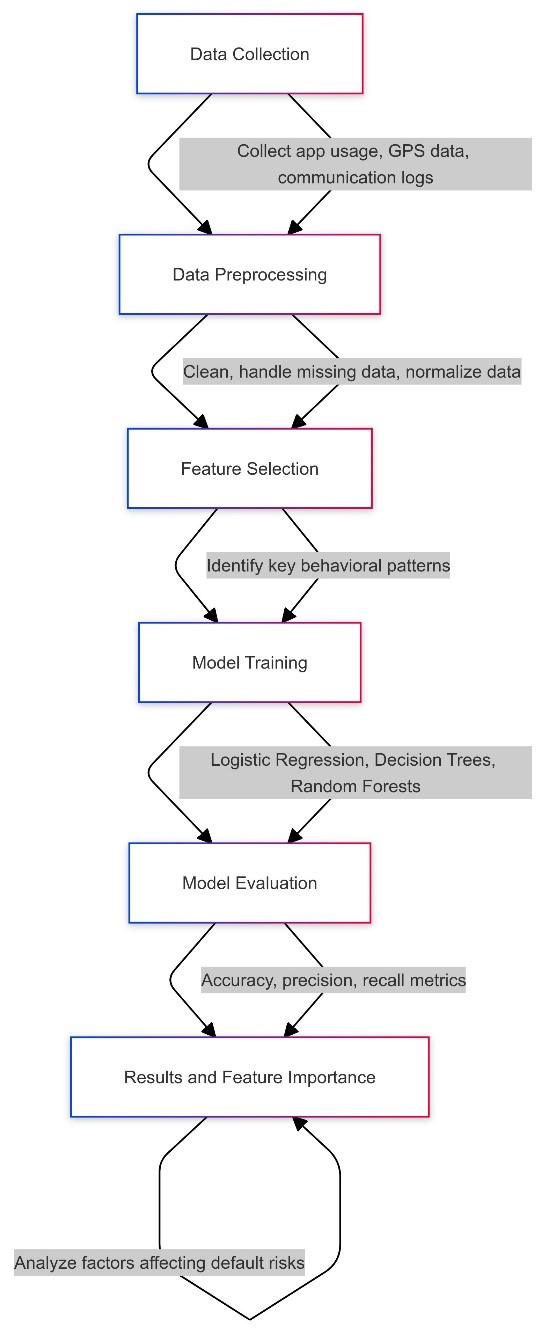

This study leverages machine learning (ML) techniques to predict financial default risks using smartphone data, providing a novel approach to financial risk assessment. Data were collected from 1,000 individuals who had taken personal loans, focusing on key behavioral parameters such as app usage frequency, GPS location data, and communication patterns over a six-month period prior to loan application. The analysis employed Logistic Regression, Decision Trees, and Random Forest models to determine correlations between these parameters and default risks. The Random Forest model demonstrated superior performance, achieving 85% accuracy. Key findings show that high usage of financial apps was associated with lower default risks, while irregular communication patterns and erratic mobility were significant indicators of higher risk. These results suggest that smartphone-derived behavioral data can significantly enhance traditional credit scoring methods. The study not only contributes to predictive analytics in financial risk management but also raises ethical considerations around privacy and data security.

Downloads